Equipment financing is a powerful tool for startups seeking to achieve sustainable growth while preserving capital. It enables quick access to essential assets like machinery and technology upgrades without straining cash flow, allowing startups to compete effectively in the market, meet customer demands promptly, and maintain financial resilience during expansion or entry into new markets. This strategic approach fosters both startup growth and adaptability in a dynamic market landscape by prioritizing technology upgrades and providing flexible repayment terms, ensuring a solid foundation for future success.

“Equipment financing plays a pivotal role in propelling startup growth and ensuring long-term sustainability. This article delves into the strategic benefits of equipment financing for emerging businesses, exploring how it facilitates capital preservation during critical early stages. By understanding these mechanisms, startups can secure financial resilience while embracing technology upgrades, streamlining market entry, and ultimately accelerating innovation. From quick access to essential tools to building robust financial foundations, discover how equipment financing empowers entrepreneurs to navigate challenges and thrive.”

- Understanding Equipment Financing for Startups: Unlocking Sustainable Growth

- Capital Preservation Strategies: How Equipment Financing Can Help Retain Financial Resilience

- Technology Upgrades Through Financing: Accelerating Startup Innovation

- Quick Access to Equipment: Streamlining Market Entry for New Businesses

- Building Financial Resilience with Equipment Financing: Long-Term Benefits for Startup Sustainability

Understanding Equipment Financing for Startups: Unlocking Sustainable Growth

Equipment financing is a game-changer for startups aiming for sustainable growth. It offers a strategic way to acquire essential assets, such as machinery or technology upgrades, without compromising capital preservation. By leveraging this financing option, startups can secure the resources needed for market entry or expansion while maintaining financial resilience. This approach enables them to compete effectively and meet customer demands promptly.

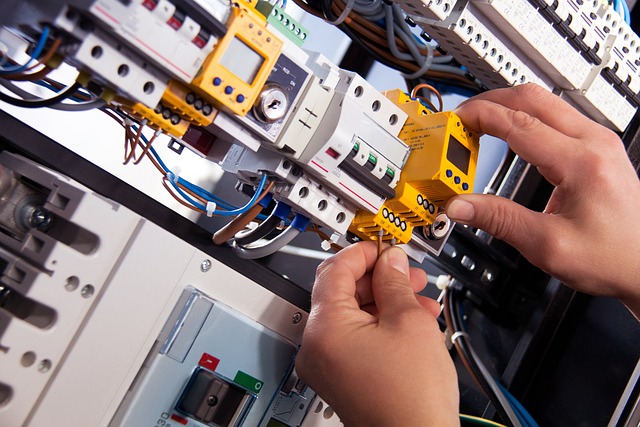

Through equipment financing, startups gain quick access to much-needed capital, allowing them to invest in modern equipment that drives productivity and innovation. Unlike traditional loans with stringent requirements, these financing options often come with flexible terms, making it easier for startups to manage cash flow while focusing on core business objectives. This strategic financial move can be the key to unlocking sustainable startup growth in today’s competitive market.

Capital Preservation Strategies: How Equipment Financing Can Help Retain Financial Resilience

For startups, navigating the delicate balance between growth and financial stability is paramount. Capital preservation strategies are essential to ensure survival during volatile market conditions. One effective approach is equipment financing, which allows businesses to acquire necessary technology upgrades without overextending their cash flow. By leveraging this strategic finance method, startups can secure high-quality equipment with quick access to funds, enabling them to enter the market swiftly and competitively.

Equipment financing provides a safety net by offering flexible repayment terms and often includes options for future technology replacements. This approach conserves capital, preserving financial resilience while fueling startup growth. It empowers businesses to make strategic investments in their operations, ensuring they remain competitive and adaptable in a dynamic market landscape.

Technology Upgrades Through Financing: Accelerating Startup Innovation

For startups aiming to thrive in today’s fast-paced market, staying ahead of the technological curve is vital for both startup growth and market entry. However, achieving significant technology upgrades can be a financial burden. Equipment financing offers a strategic solution that enables young companies to gain access to necessary tools and machinery without compromising capital preservation. This method allows entrepreneurs to quickly acquire advanced resources, fostering innovation and enhancing their competitive edge.

By securing financing for equipment, startups can obtain cutting-edge technology with minimal upfront costs, ensuring they don’t miss out on opportunities due to cash flow constraints. It promotes financial resilience, enabling businesses to adapt and evolve swiftly. This quick access to capital preserves the startup’s ability to pivot and seize new possibilities, ultimately accelerating their journey towards success in a dynamic business landscape.

Quick Access to Equipment: Streamlining Market Entry for New Businesses

New startups often face a significant challenge when it comes to acquiring the necessary equipment for their operations. Traditional financing methods can be time-consuming and may require substantial upfront capital, which is a concern for young businesses aiming for quick growth. However, equipment financing offers a solution that provides startups with quick access to essential assets without compromising financial resilience. This funding method allows entrepreneurs to obtain the technology upgrades needed to hit the ground running, navigating the competitive market with agility.

By leveraging equipment financing, new ventures can secure machinery, software, or vehicles required for their unique operations, fostering sustainable growth. This approach enables startups to maintain healthy capital preservation while building a solid foundation for future success. With access to much-needed equipment, businesses can focus on what they do best, innovating and providing value to their customers without being hindered by financial constraints at the onset of their journey.

Building Financial Resilience with Equipment Financing: Long-Term Benefits for Startup Sustainability